by David Dawe, Valerien Olivier Pede and Ronald Jeremy Antonio

Good news: the recent developments in the global rice trading environment and improved weather conditions have lowered world market prices. As these factors lead to lower domestic prices, consumers will find it easier to afford a healthy diet.

Improved trade

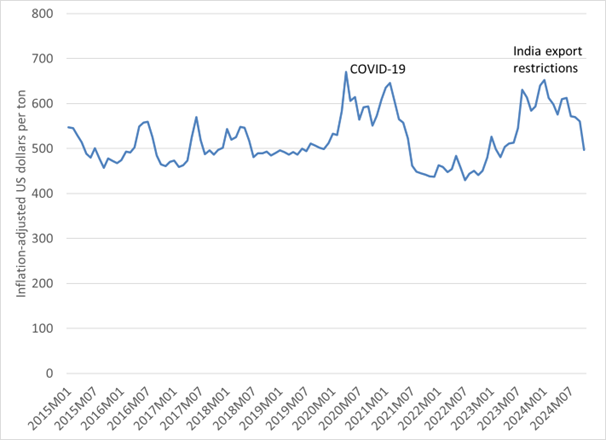

World prices are now back to levels last seen before India’s restrictions were imposed in July 2023 (see the latest data point in Figure 1). This shift is largely influenced by the major rice trade policy changes in both the world’s largest exporter (India) and the world’s largest importer (the Philippines) in the past months.

Beginning in late September and continuing over the succeeding weeks, India removed nearly all restrictions on rice exports in the face of large domestic stocks and prospects for an excellent forthcoming crop. These restrictions included a ban on non-basmati non-parboiled rice exports (with some exceptions for countries that needed imports for food security), a minimum export price on basmati rice and an export tax on parboiled rice, paddy, and husked rice.

Meanwhile in July, the Philippines lowered tariffs on rice imports from 35 per cent to 15 per cent, in response to elevated domestic rice prices.1 However, the global market reaction to the lowering of tariffs in the Philippines was muted – in fact, Thai export prices fell when the lower tariffs took effect. In contrast, the global market reaction to the relaxation of India’s rice export restrictions was swift and unequivocal: Thai export prices recorded a 9 per cent drop in the week immediately after the policy change.

The stronger market reaction to the changes in India’s trade policy can be attributed to India’s significant share of world rice exports – estimated at about 40 per cent – which is much larger than the Philippines’ share of world rice imports (based on USDA 2025 trade projections). Thus, India has more influence on the world rice market than does the Philippines, even if the latter is the world’s largest importer. Furthermore, the short-term impact of the lower Philippines’ tariffs was clouded by farmers’ unsuccessful appeals for a temporary restraining order to nullify the executive order to lower tariffs.

Better weather, lower prices

Changes in weather patterns and near-term production prospects have also contributed to lowered prices.

The end of El Niño has provided significant relief to world market prices. El Niño negatively affected rice production in Southeast Asia in particular, where production declined by 2.3 percent compared to the previous year. While La Niña looms on the horizon, the most recent forecasts suggest that it will be weak. Additionally, La Niña has generally less effect on rice production than El Niño. Thus, USDA projects rice production in Southeast Asia to increase by 0.8 per cent.

The monsoon in India has been relatively manageable, although there has been some flooding in parts of the country. Nevertheless, USDA projects production to be up 5 per cent due mainly to more harvested area. Overall at the global level, USDA projects rice production to ramp up by 2.2% for next year. Finally, global stocks are at relatively comfortable levels. These improved weather and trading environment should help to stabilize the world rice market and provide an opportunity for governments to bolster the food security of poor rice consumers.

1The Philippine tariff rates specified refer to imports from ASEAN countries, which account for nearly all the Philippines’ rice imports. Higher rates apply to imports from some other rice exporters.